Advantages at a glance

- Your online banking login details are the key for accessing online banking. If your login details have been compromised, you will no longer be able to continue using them to log in.

- You can now save the devices you use most frequently as trusted devices by verifying them with an additional security check. Once done, you will be able to log in from these devices in future without any additional security checks.

How to

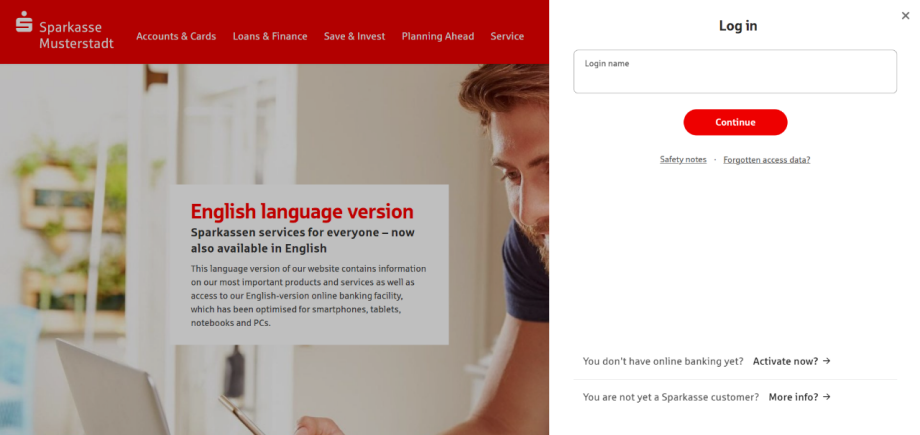

When logging into online banking, you can save the device you are using as a trusted device.

Logging in from a new device?

- If so, you will always need to verify your identity by pushTAN or chipTAN in addition to entering your user name and online banking PIN. This is designed to make online banking even safer.

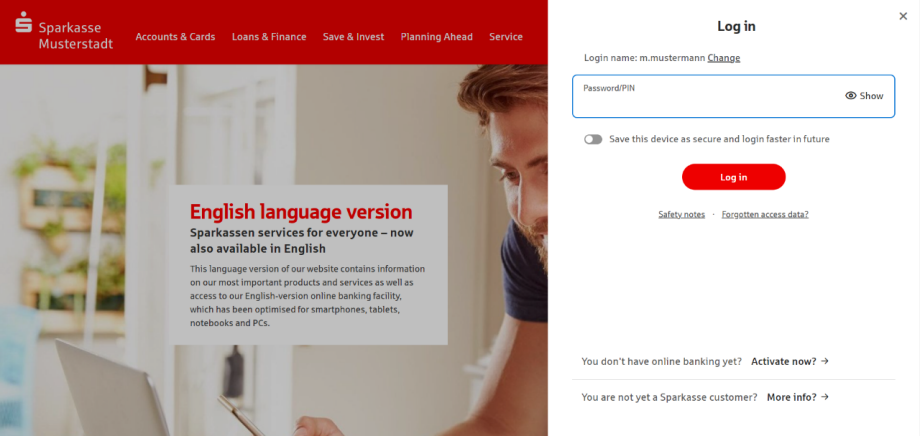

Logging in from a trusted device?

- If so, the system will recognise your device and you’ll only need to enter your user name and online banking PIN to log in.

In future, when logging in, you can choose to save the device you are using so that you will not have to pass an extra security check in future when logging in from this device.

After clicking [Continue], the application will check whether the device is already known and has been saved. In this scenario, the device has not yet been saved. Next, the input field for entering your online banking PIN will come up. There will also be a button (toggle switch) you can use to save the device if it has been recognised.

In future, you will also be able to see that you are logging in from a recognised device when logging in.

Important prerequisite: Allowing cookies

In order to enable the system to recognise trusted devices, it will be necessary to place a cookie on them. This is why you will need to allow cookies in your browser. It will also be unable to recognise trusted devices if you delete cookies or use a different browser. In this case, you will need to verify your identity again when logging in.

When visiting our online banking website, the device ID cookie required for our system to recognise your device will be automatically stored on your device. This cookie contains a randombly generated number (UUID - Universally Unique Identifier) that will be stored in your browser as a cookie attribute.

Due to the fact that this is security-related, technical information similar to a session ID, the cookie is classed as a “necessary cookie”, which does not require explicit consent.

Please refer to our privacy policy, Section III.2 Cookie use - for information on cookie categories and storage periods.

FAQ

Our website will memorise the device or browser from which you log into online banking during the log-in process. This applies regardless of whether you are using a computer, notebook, tablet or smartphone.

Each time you log in after that, our website will automatically check whether it recognises your device or browser.

In future, you will only be able to log into online banking after passing two security checks. This will make online banking safer and is the same as the additional TAN or S-pushTAN app verifications already needed to make transfers.

It is called two-factor authentication, significantly increases online security and is currently the gold standard for protecting access to accounts.

Device recognition is a method that was developed in order to make two-factor authentication easier. When logging in from a trusted (known) device, you will be able to continue logging in – just as before – after passing just one additional security check, which is entering your PIN.

No, device recognition is not compulsory, but we would recommend it. If you do not opt for device recognition, you will have to pass two security checks every time you log in. This means you will have to enter your PIN and a TAN or verify your identity through the S-pushTAN app.

This is most probably because you have deactivated cookies in your browser, which can be easily remedied by activating them. Some browsers are configured to automatically delete all cookies when they are closed.

Sometimes, your cookies may also be deleted by anti-virus software or a browser plugin you may be using. Please make sure that it is possible to use cookies on your device for online banking if you want to use device recognition.

You may be required to pass an additional security check by entering a TAN or verifying your identity through the S-pushTAN app when logging into online banking in the following cases:

- Saving a device as trusted does not remove the need to regularly verify your identity for online banking as legally required under the EU Payment Services Directive (PSD2). This is why you will still be required to verify your identity again every now and then by entering a TAN or through the S-pushTAN app in future.

- If you are using a new device that you have never used before (e.g. new notebook, tablet or smartphone) or a new browser.

- You have configured your browser to delete cookies every time it is closed.

- You are using a private browsing mode on your browser.

- You are using additional software, firewalls or browser plug-ins that block certain browser functions.

- With some virus scanners (e.g. Kaspersky), it may also be necessary to define corresponding exceptions.

- If you do not use device recognition, you will always have to verify your identity by entering a TAN or on the S-pushTAN app in addition to your user name and PIN every time you log in.

There is currently no limit on the number of devices you can save.

Yes, they are free.

Once you have started using device recognition, the online banking login procedure will be spread over two screens, which can sometimes cause problems with password managers.

The same applies to browser-based password managers. These problems can usually be easily resolved by simply entering your login details again.

Important: If you have forgotten your login details, there is usually no need to ask for new ones. This is because they will still be saved in your password manager or browser. In most browsers, you’ll be able to find the password manager under Settings.

Please note that, in line with the due diligence obligations set out in our T&Cs, you are legally required to protect your online banking passwords. Hence, please make sure to protect access to any login details saved online with a (master) password.

Staying save online

Protect your accounts from unauthorised access. Keep up-to-date with your Sparkasse’s latest security alerts and follow a few simple online safety rules.

We, your Sparkasse, use cookies that are essential to providing access to our website. If you consent to the use of cookies, we will use additional, non-essential cookies in order to process information on your use of our website for analytical (e.g. to measure reach) and marketing purposes (e.g. to personalise content). As part of this, Google may also provide us with additional data. We also use cookies to assign visitors to specific target groups and provide these target groups to Google for advertising campaigns. For more detailed information about these cookies, please see our Privacy Statement. Cookie consent is optional and not required in order to use this website. To select the kind of additional cookies you are happy for us to use, please click on “Change settings”. You can also consent to the use of all additional cookies by clicking on “Agree”. You can withdraw your consent at any time or change your cookie settings by clicking on the “Change cookie settings” link at the bottom of each page. If you click on “Decline”, we will not use any additional cookies.